Global Nicotine Pouch Market: 2023-2032 Insights and Forecast

Table of contents

- State of the nicotine pouch market in 2023

- The average nicotine pouch user in the U.S. by the numbers

- How has the market evolved?

- Where is the nicotine pouch market going in the future?

- The future looks bright for the nicotine pouch market

- References

Nicotine pouches may make up just a small amount of the current smokeless tobacco market today, but this product is projected to experience significant growth over the coming decade.

The overall market is expected to grow from $26.30 billion in 2022 to an impressive $64.29 billion by 20321. And then there is the nicotine pouch segment, which as of 2023 has a market size value of $2.04 billion. But by 2032, analysts predict that the value will skyrocket to $26.80 billion in revenue2. All signs point to major U.S. and Asia-Pacific growth as a driver for the estimate.

As these products became popular in European nations over the past decade, the use of nicotine pouches (also referred to as “modern oral nicotine products”) has since increased around the world. You can also now find them in a wide variety of sizes, strengths, and flavors, from a number of reputable brands.

Nicotine pouches fill a market need that’s not met by other oral nicotine products. And they may actually appeal to a different demographic altogether. Who enjoys them most? What trends are most impactful for this product? Where will the market go from here?

As we reflect on what the current marketplace looks like for nicotine pouches, we can get a better view of what to expect over the next decade.

State of the nicotine pouch market in 2023

Before we can consider the future of nicotine pouches, we must start with the market gains experienced by this relatively small share of the overall market. Pouches fall into the grouping of alternative tobacco and tobacco-free products, which includes e-cigarettes, smokeless tobacco, and nicotine gum.

The total global market for these products was $26.30 billion in 2022, and nicotine pouches represented $1.60 billion of that amount. Pouches saw an increase to approximately $2.04 billion for 2023, showing significant growth for this segment.

Europe dominates the marketplace

Notably, Europe continued to dominate the nicotine pouch market this past year, but the North American market made up the largest revenue share for the entire alternative tobacco and tobacco-free market.

The market shift may have been influenced by younger people (aged 21 and older) who want to stop or avoid smoking cigarettes without giving up nicotine completely. Health education, public service ads, and product packaging are clearer now than ever about the harms of traditional tobacco products.

As more marketing discourages people from ever starting smoking cigarettes, we may see a stronger movement toward modern oral nicotine products.

The average nicotine pouch user in the U.S. by the numbers

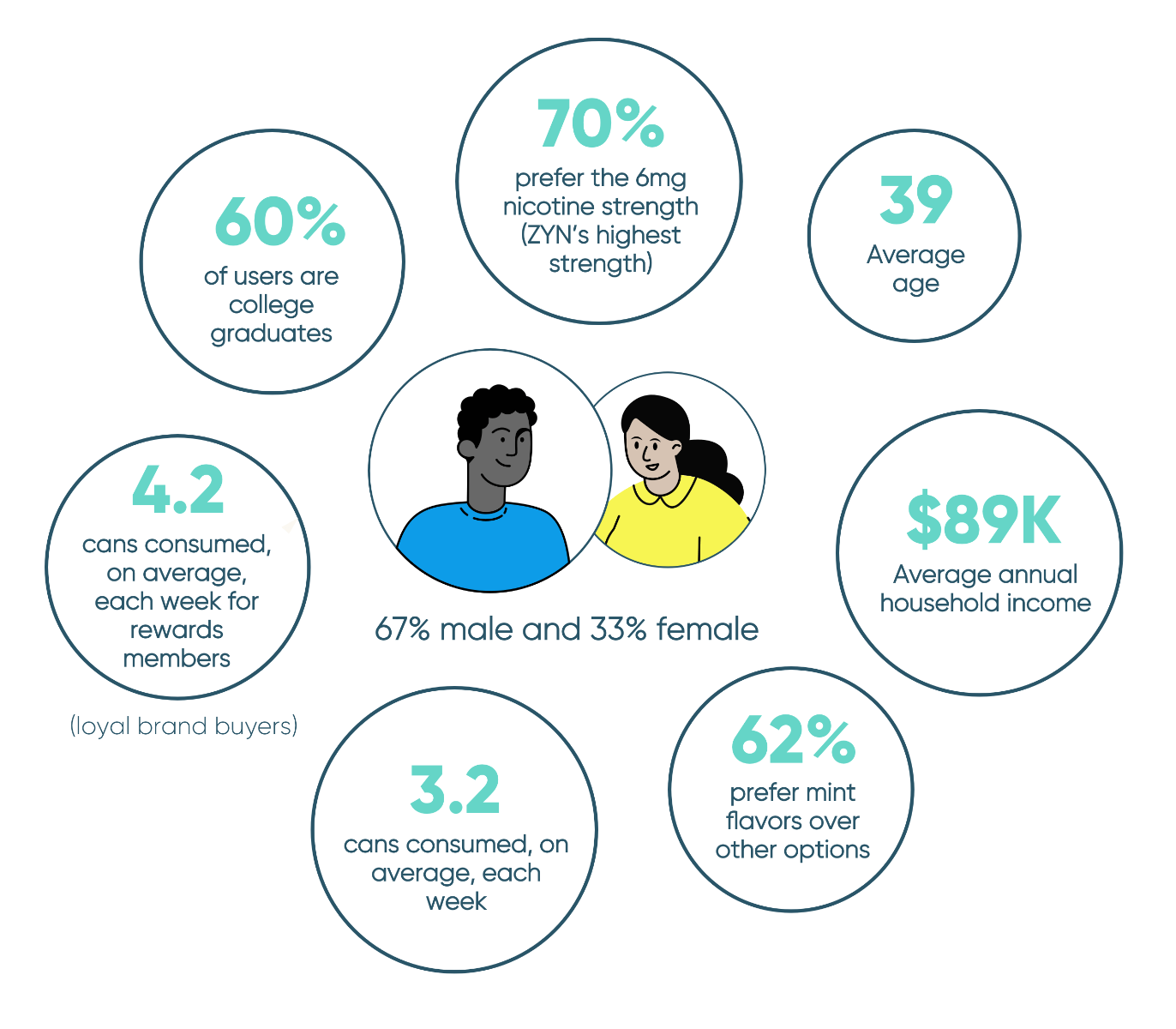

Before we get into the specifics, it’s important to state that there is no set demographic for a nicotine pouch consumer. Part of this is because it’s a global market, so what may be an acceptable social norm in one country may be frowned upon in another. However, we do have demographic data for users in the U.S.3:

- Average age: 39 years old

- Average annual household income: $89K

- 60% of users are college graduates

- 67% male and 33% female

- 3.2 cans consumed, on average, each week

- 4.2 cans consumed, on average, each week for rewards members (loyal brand buyers)

- 62% prefer mint flavors over other options

- 70% prefer the 6mg nicotine strength (ZYN’s highest strength)

When asked what they used before switching to nicotine pouches, 36% of ZYN buyers used traditional oral products, like chewing tobacco. 20% were former cigarette smokers, and 25% used to vape.

How has the market evolved?

Two major changes—and one potential change coming soon—occurred in the last few years, and they set the stage for shifts in U.S. nicotine pouch sales.

Online retailers

One change involves the distribution channels of these products. Online pharmacies and stores generated the largest revenue share for alternative tobacco and tobacco-frees products in 2022. This category includes nicotine pouches.

Why are online stores such an ideal choice for buying nicotine pouches? Let’s take a look at a few of the top reasons:

- Ecommerce provides a large selection of brands, varieties, and product sizes in a single store

- Promotional offers, discounts, and bulk pricing make it convenient to shop from home and save money.

- People are accustomed to buying more items online, with prescriptions, OTC medications, and tobacco-free products now more convenient than ever.

- Online shopping offers a way to buy products discreetly and securely.

Major acquisition

The second major development is Imperial Brands’ 2023 acquisition of nicotine pouch products from TJP Labs. This move may help the company make big gains in the U.S. market through new products and pricing moving into 2024.

ITG Brands, the U.S. subsidiary of Imperial Brands, is slated to offer 14 nicotine pouch variations under a new name. These pouches have early approval from consumer testers and set the stage for an influx of new options for both new and established nicotine pouch users.

Potential FDA rulings

In 2024, we may see additional movement toward smokeless nicotine products as the FDA finalizes its rule on menthol cigarettes. Past studies show that while overall cigarette use among teenagers has declined greatly over the past decade, the numbers remained largely unchanged for the non-Hispanic Black and Hispanic youth population5. There was also little change for middle-grade smokers.

One possibility is that by reducing access to menthol cigarettes, adult smokers who got their start as teens could pursue options in tobacco-free categories, including mint-flavored nicotine pouches.

Where is the nicotine pouch market going in the future?

Most of the studies, reports, and surveys conducted by industry experts provide an early look at what we may see in the years leading up to 2032. This decade-long forecast shows strong growth opportunities in almost every country that currently sells nicotine pouches, and some of the predictions aren’t at all surprising.

The U.S. market has room to grow

ZYN’s manufacturer (Philip Morris International) claims that the U.S. nicotine pouch market is still “in its infancy” and has committed to focusing marketing spend and influence in the States. Nicotine pouch use in legal-aged, U.S.-based nicotine users is just under a third of what it is in Sweden6, while Norway has 4.8 times the users than the U.S. In Iceland, the country has almost reached full market capacity and features 8.6 times the nicotine pouch users compared to the States.

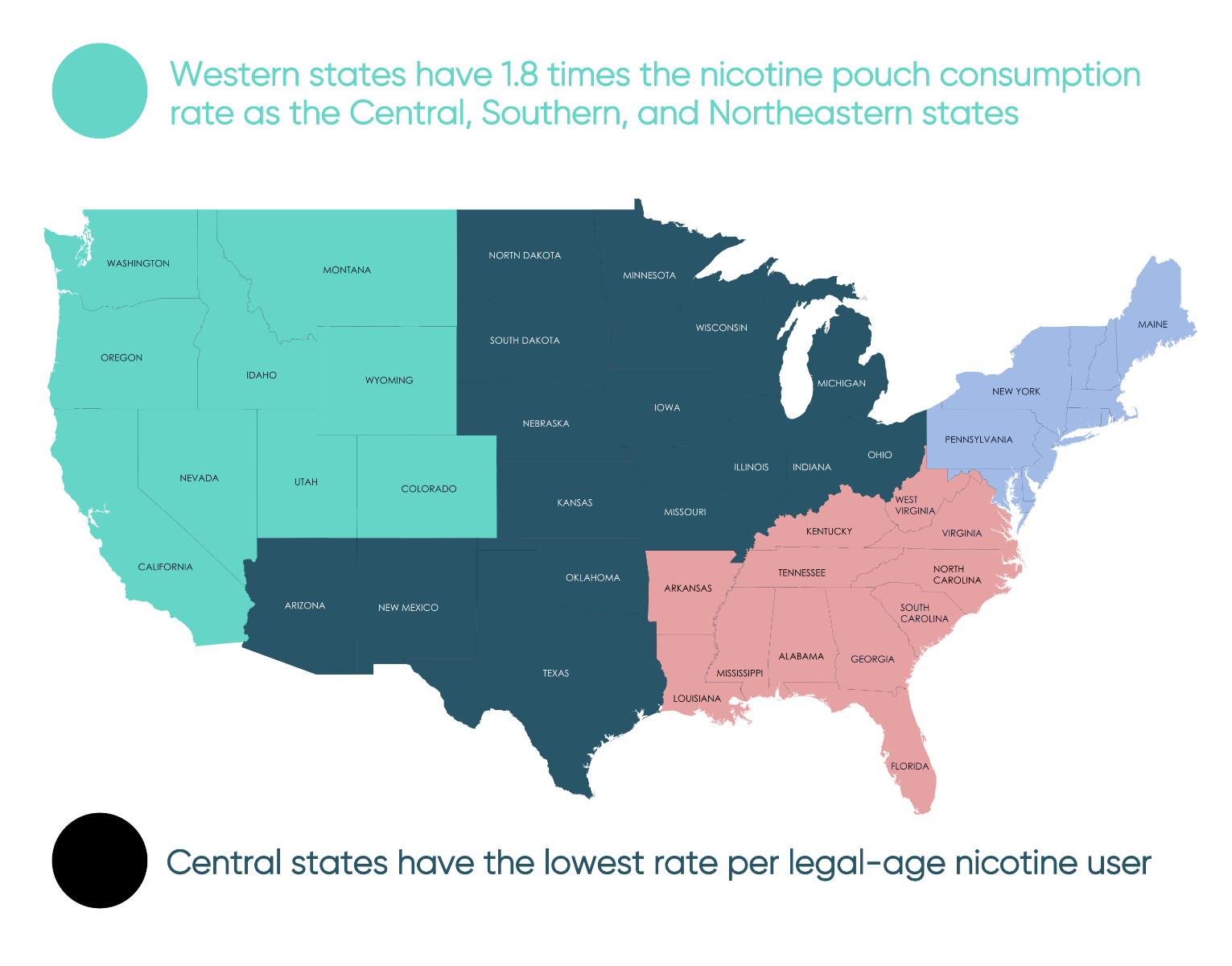

Adoption may not happen evenly across the U.S. Currently, the Western states have almost 1.8 times the nicotine pouch consumption rate as the Southern, Midwestern, and Eastern states. The Central states have the lowest rate per legal-age nicotine user. This gives nicotine pouch companies the big opportunity to grow their numbers, even in some of the most sparsely populated areas.

Smokers are learning about their options

Visit any convenience store or gas station in the U.S., and you'll see at least one nicotine pouch advertisement plastered on the window. Despite the very prominent promotion tactics used by nicotine pouch brands, there is a lack of knowledge about these products.

A Rutgers University study revealed that only 29% of U.S. smokers knew about nicotine pouches, and a mere 6% had tried them before7. This demonstrates a major opportunity for education around nicotine pouches. Increasing those numbers by even 10-15% more of the smoker population into the awareness stage could be enough to move the U.S. consumption level up a few points.

Additionally, 17% of the smokers indicated a desire to use nicotine pouches in the future. This group includes those who are interested in quitting in the future or have tried to quit and were unsuccessful.

We also don’t know how many of those in that 17% use menthol products, which will soon become difficult (if not impossible to buy) due to the aforementioned FDA regulations. If forced to give up menthol products, these consumers may find the motivation to kick their habit by changing to pouches. The Rutgers study’s participants expressed a higher likelihood of switching to nicotine pouches than chewing tobacco or snus.

Synthetic creates new opportunities

There’s a growing divide over the “best” nicotine pouch in terms of its origins. Is it a natural pouch with nicotine derived from the parts of the tobacco plant? Or is it better through lab processes as a completely synthetic material? The jury is out on what consumers want, and synthetic products are still fairly new to the market.

As the FDA determines how to regulate both types, it’s clear that the market is ripe for new synthetic players. With more products hitting the market from brands like Rush and NIIN, consumers will have another choice to make at checkout. “Do I order lab-made nicotine or farmed?” Each has its perceived benefits, and branding may have the final say in which option nicotine pouch users decide to buy.

With synthetic officially in the game, market share could split before seeing bigger overall numbers for the modern oral nicotine sector.

Unflavored pouches may hold the most promise

Despite the potential ripples in the menthol cigarette market and the array of flavored nicotine pouch options available, early data points to unflavored products holding the power to change markets.

Why do we anticipate this? For one, not every state permits the sale of flavored nicotine pouches. Some states have “flavor bans” that serve as a wide ban on all flavored tobacco products.

Even though nicotine pouches are technically not considered tobacco, classifying them as such simplifies the law. So, in states like New York, which has banned flavored vapes and tobacco products, stores cannot sell nicotine pouches in varieties like Sour Apple or Fresh Mint.

With the FDA menthol ban close to seeing resolution, states could very well use it as a push toward unflavored pouches. The demand for unflavored options among nicotine pouch users contributes greatly to market sales.

As long as ecommerce sellers can respond to changing market conditions and keep a large variety of unflavored options in stock, consumers will still feel they have a choice. Top brands are continually looking at new unflavored products to feed the need for experimentation, too.

Asian-Pacific region may see a surge

The Asian-Pacific region has seen significant market growth, a trend the International Money Fund (IMF) doesn’t expect will slow down much over the next few years8. It was expected to grow 4.6% in 2023 (up 3.9% from the previous year), and 2024 has a forecasted growth of 4.2%. The region is also experiencing less disruption from factors like inflation and trade due to commerce practices.

Will this mean more money to spend on products like nicotine pouches? Manufacturers hope so9. With high growth in wages expected across much of the region, including more than 10% for Pakistan, paychecks may keep pace with inflation. Manufacturers like Philip Morris have identified Pakistan, in particular, as a prime market to target in 2024 and beyond.

U.S. budgets may impact purchasing habits

There’s no getting around how much items cost these days. When it comes to enjoying nicotine, one product is clearly the most expensive. The average U.S. retail price for a pack of cigarettes was $8 in 2023, with the cost rising to almost $10 in New York State. For many consumers, this is just unsustainable.

Those who have tried to quit and have not been successful may find themselves searching for a more wallet-friendly alternative. Considering that the average price of a pack of ZYN is just $5 nationwide, the swap to pouches is simply a more affordable alternative.

The future looks bright for the nicotine pouch market

Estimates for the future set a lofty goal for nicotine pouch sales, but the large projections have some trend information to back them up. For example, the compounded annual growth rate of 33.16% includes new markets, such as those in the Asia Pacific region, as well as new synthetic products. We may also see a significant move based on budget reasons, as consumers have expressed they are running out of places to pinch pennies in this inflated market.

Wherever the market goes, brands are ready with new varieties and a host of marketing materials designed to help consumers with their purchasing decisions. If there’s one thing the nicotine pouch manufacturers have in common, it’s time to market. These brands seem to have big ideas for changing the industry and may be well rewarded for their ingenuity over the next decade.

References

- Retrieved 10 November 2023 - Yahoo Finance - https://finance.yahoo.com/news/global-alternative-tobacco-smoking-cessation-143000128.html

- Retrieved 13 November 2023 - Polaris Marketing - https://www.polarismarketresearch.com/press-releases/nicotine-pouches-market

- Retrieved 15 November 2023 - PMI - https://philipmorrisinternational.gcs-web.com/static-files/a86c6d92-8e5b-4e8e-ae88-3914c1f92c03

- Retrieved 15 November 2023 - FDA - https://www.fda.gov/tobacco-products/products-ingredients-components/menthol-and-other-flavors-tobacco-products

- Retrieved 17 November 2023 PubMed - https://pubmed.ncbi.nlm.nih.gov/32347935/

- Retrieved 15 November 2023 - PMI - https://philipmorrisinternational.gcs-web.com/static-files/a86c6d92-8e5b-4e8e-ae88-3914c1f92c03

- Retrieved 18 November 2023 - Rutgers University - https://www.rutgers.edu/news/first-look-emerging-tobacco-industry-product-shows-new-consumer-interest-and-awareness

- Retrieved 18 November 2023 - IMF - https://www.imf.org/en/Publications/REO/APAC/Issues/2023/09/27/regional-economic-outlook-for-asia-and-pacific-october-2023

- Retrieved 13 November 2023 - Polaris Marketing - https://www.polarismarketresearch.com/press-releases/nicotine-pouches-market